Unlike buying a home to live in, an investment property is usually bought with a goal of making money (usually via rent), which makes things that might be important when looking to buy a home (such as proximity to your workplace) be not as important when looking for an investment property.

There are many reasons why investing in property continues to be a popular choice and is often seen as one of the best ways to invest money in Australia. However, mistakes can be expensive, so it is always a good idea to be careful and rethink many times about why you’re investing in the first place, and whether it fits with your circumstances.

Buying an investment property can be an overwhelming decision. To help you navigate the investment process, this guide to investing has been developed to provide you with everything you need when starting out your property investment journey. With the help of various tips and checklists, this useful guide aims to help you secure the right investment property.

Why Invest in Property?

Despite the current downturn in house prices in some property markets, particularly Sydney and Melbourne, there are still many reasons why making a long-term investment in Australia a good decision to build your overall wealth.

For one, based on historical data, investing in real estate provides above average returns than many asset classes in Australia. Investment property in Australia has enjoyed a strong long term average annual growth rate.

Another, future demand is given. Thanks to the increasing population and declining household size that are driving this demand. BIS forecasts reveal that there is still a huge housing future demand ahead, with an additional 620,000 households required across the country by the year 2030. This demand will just continue to prop up real estate prices in the years ahead.

In addition, the Australian government offers generous tax advantages through negative gearing. And this is being used by many average Australians and high-income earners to reduce their taxable income.

Pros and Cons of Property Investment

| Pros | Cons |

| Capital Growth: The value of your property will grow over time and may be extremely beneficial financially if well chosen. Not only will you benefit from steady capital growth, but regular monthly rental returns. | Liquidity:Although you can sell your property if things get tough, the process is not as quick as it is to sell other investments such as shares. |

| A safe investment: This is the only investment market which is not dominated by investors, hence creating a natural buffer in the market. It is also the most forgiving investment; if you purchase the worst house in the area, chances are that its value will still increase over time. | Hidden and ongoing costs: Along with the initial costs of investing in property (i.e. stamp-duty, deposit, legal and conveyance fees), you will need to consider the ongoing hidden costs of property investment such as fitting out the property, maintenance and repairs, building and landlord insurance, land tax, water rates, council rates, etc. Other investments such as shares do not incur ongoing fees. |

| Mitigate risk: You can insure your asset against most risks – fire / damage / a tenant leaving, damaging your property or breaking the lease. | Rent free periods: During the periods when you are unable to find a tenant and the property is vacant, you will need to cover the mortgage repayments. |

| Anyone can invest: You do not have to possess a vast amount of knowledge, as you may with stocks or opening up a business. | Bad tenants: Problematic tenants are every owner’s nightmare. They can severely damage your property, refuse to make payments and sometimes even refuse to leave the property. Some disputes can take months to resolve also and become very stressful, especially if there is an emotional attachment to the property. |

| Control: Unlike other investments, you are in full control of your property investment; you can make all the decisions and have control over all of your returns. | Other costs: Although negative gearing may offer tax deductions, you will need to consider and budget for the shortfall between ongoing costs (which includes repayments) and rental income, as well as other costs to cover all outgoings when the property is vacant. |

| Tax benefits: Although tax benefits should not be used as a decision-making factor, it can be a benefit when investing in real property. If your property is negatively geared, it may provide tax benefits. |

“Get your Access to our Fully Customisable Investment Property Research and Analytics Tool Now!”

What are the Costs of Investment Property?

The cost of an investment property is not limited to the house; there are fees, taxes, rates and mystery deductions that can really make a dent for the unprepared buyer. We’ve listed some of the extended costs you can expect to incur when buying an investment property.

Upfront: What you pay at the beginning of your investment property

- Bank fees: Some banks charge an application or confirmation fee when taking out a home loan.

- Lenders Mortgage Insurance: A one-off payment that protects the bank in case you’re unable to pay off your mortgage. It’s usually only required for loan amounts greater than 80% of the total property cost.

- Legal obligations: Processing a transfer of property ownership is most often covered by a solicitor or conveyancer. You could expect to pay up to $1,500 for these services.

- Stamp duty: This is often one of the biggest costs you will face. Stamp Duty is a government land transfer tax that differs depending on the state, type of property and your personal circumstances.

Ongoing costs to maintain a rental property (weekly, monthly or annual basis)

- Accountants: Considering the volume of rental income and myriad laws around capital gains and negative gearing policy, it’s wise to consider an accountant to handle your tax returns at the end of every financial year. They’ll consider things like depreciation, rental income, and expenses. Your accountant will educate you on expenses that you can claim (e.g. repairs, maintenance and legal expenses), as well as expenses that can’t be claimed (e.g. the house itself, stamp duty, or tenant-paid bills).

- Bank fees: Some banks charge an annual fee to continue your home loan.

- Council rates: Rates keep your neighbourhood services running smoothly and are paid by the property owner (not the tenants) on a quarterly basis.

- Investment property insurance: Refers to the property/building insurance and landlord insurance to help you in case of damage (including that caused by tenants) or unpaid rent.

- Interest: Whether fixed ( where you pay the same rate for the term of the fixed rate) or variable (where the rate can change at any time), you’re going to be charged interest on your investment property loan.

- Land tax: Land tax varies depending on the state/territory you live in, and whether your property’s value exceeds that of the threshold. Often paid by the investment property owner unless covered by a special agreement with the tenant.

- Property maintenance: Any work carried out to maintain or fix parts of the property (i.e. cleaning gutters or fixing plumbing). Again, the cost to maintain a rental property is the responsibility of the landlord and not the tenants. Oftentimes, this activity is tax deductible, but be sure to check with your accountant.

- Property management fee: You may elect a property manager to help find tenants, process maintenance requests and any other duties to lighten the workload of being a landlord. Property managers normally charge a certain % of the rent as ongoing management fee for their services.

- Taxes: There are 3 main taxes Australian investment property owners may need to pay — Income Tax, Capital Gains Tax and Goods and Service Tax. These differ depending on the owner, the state and the property, so ensure you’re researching with your relevant authority.

- Strata fees: Often known as Body Corporate fees, these occur when your investment property is within an apartment block or townhouse complex. These pay for shared services and maintenance of the building/surrounds.

Capital Growth or Cash Flow?

Cashflow suggests you want rental returns that are higher than your outgoings (including mortgage payments), leaving money in your pocket each month.

While Capital Growth suggests that you need to buy a property that produces above average increases in value over a long term period.

Investment properties in Australia with higher capital growth usually have lower rental returns. Whilst those areas with high rental return, mostly in regional areas and secondary locations, usually have lower long term capital growth.

So how can you get the best of both worlds?

Achieving a positive cash flow and a high long term capital growth on your investment property can be quite tricky. Generally, you can’t easily turn a cash flow positive property with a slow growth into a high growth property, because of its geographical location. But you can turn a high growth property with relatively low cash flow, into a strong cash flow property. How? By renovating or developing your property! Depending on the condition of your property, renovating and developing, more often than not, can bring in higher rent and extra depreciation allowances for your property, thereby producing a strong cash flow.

It’s really all about knowing how to invest in property that you can achieve both high returns (cash flow) and capital growth. Cash flow keeps you in the game while capital growth gets you out of the rat race.

What Makes the Right Location for Investing?

Location is vital to acquiring a good investment property. If the location is chosen correctly, the chance of gaining higher returns from your investment is far greater than if the location is not desirable and suitable for those looking to live close to amenities.

Some points to consider are:

- Close proximity to certain amenities increases the desirability and value of a location and property; these include:

- Schools

- Public transportation

- Public facilities (post office, libraries, parks, medical centres, etc.)

- Shops and markets

- Lifestyle activities (restaurants, café strips, beach, etc.)

- Avoid areas that are likely to be dependent on a sole industry i.e. manufacturing. Although it can be beneficial when the industry is doing well, if it falls, your property’s value may decline as a result.

- Some of the best places to buy are those experiencing population growth. As population grows, infrastructure improves and the desirability of an area increases.

- Living within close proximity to a major city (i.e. 10 kilometres) is always highly sought after. Whilst many of these suburbs attract higher prices, look for emerging suburbs which may have strong growth potential.

But where is the best place to buy an investment property? What are the best suburbs to invest in? Where can you buy property for below $500,000 with a Rental Yield of 5% and above? These are the most common questions property investors ask and it involves a lot of time researching to find answers to all of these.

The good news is, we’ve already done the hard work for you. Within seconds, you’ll be able to identify which suburbs you should buy a property in based on your budget.

By just filtering and sorting, you’ll be able to identify which suburbs

- Have a good demographics of people

- Have a median price that will suit the amount you’re willing to invest, especially the suburbs with a median of $500k and below

- Have More than 5% Annual Capital Growth

- Have More than 6% Rental Yield

- Have Less than 3% Vacancy Rate

It is the most comprehensive location report of all 15,000+ suburbs in Australia – with linked state, suburb, and postcode. It’s the perfect tool for property investors looking to buy a property to rent out rooms individually to have a positively geared portfolio.

Once you’ve identified which suburbs are the best for investing a property in, don’t forget to do your due diligence if the numbers stack up.

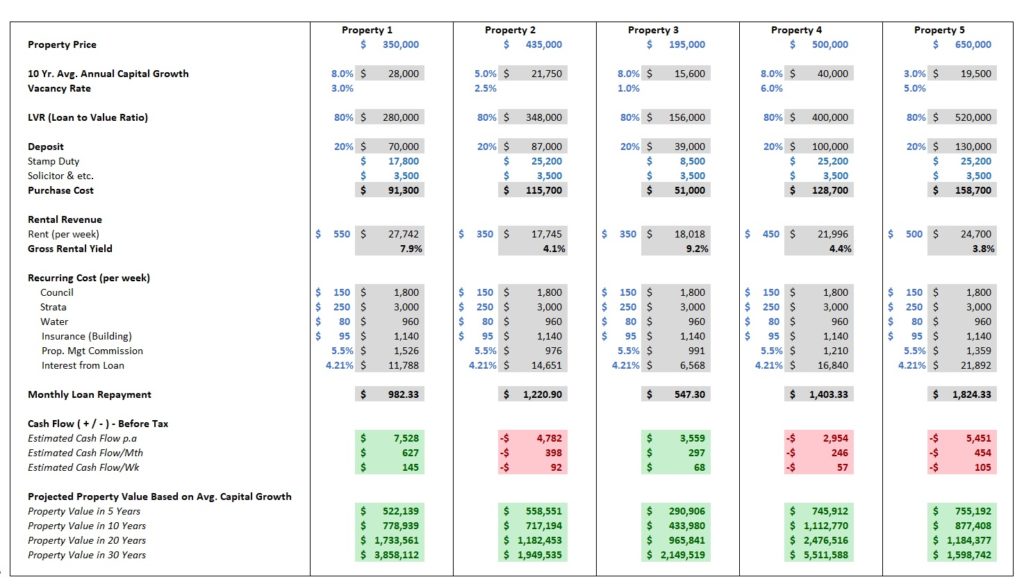

Check out our All-in-One Investment Property Calculator

The most simple and easy to use tool to calculate Rental Yield. It gives you a quick way to compare returns on different investment properties (or investments). It’s a Rental Yield Calculator, Mortgage or Home loan Calculator, Cashflow Calculator, and a Purchase Cost Calculator. It even calculates the Forecasted Property Value by Capital Growth at the same time. It’s the perfect tool for property investors, buyer’s agents, and real estate agents.