Vacancy Rate is the rate of vacant rental property to all available properties in an area, such as houses or apartment buildings. It is calculated as a percentage of dwellings in a rental property that is unoccupied at a particular time period.

In real estate terms, vacancy rates primarily represent properties that are vacant and ready to rent, properties that were shut down after a tenant left, and properties that are currently unrented because they need to be repaired or renovated.

Vacancy rate is an important real estate data to take into account when researching an investment property. You want your property to be rented as quickly as possible, you don’t want it to remain empty for weeks or months and even longer before it is rented.

How to Calculate the Vacancy Rate

Checking the vacancy rate of a property or suburb should be one of the first things you research as part of your due diligence. You will need two data points to calculate the vacancy rate:

- the number of rental properties in the area and,

- the number of vacant properties in that area

For example, if we have 500 rental properties and 15 of them are vacant, our vacancy rate will be 15 ÷ 500 x 100 = 3%. A low vacancy rate indicates that a property has strong rental sales while a high vacancy rate suggests that a property is not renting well.

Areas with a low vacancy rate will ensure a better yield for investors as their properties are less likely to remain vacant after a tenant moves out.

Why Vacancy Rate is Useful

You can use the vacancy rate to project a fairly accurate return on investment for a rental property. The vacancy rate tells real estate investors how secure their rental income is, allowing them to adjust their investment strategy.

It also tells property owners how their properties are performing rent-wise when compared to the area’s vacancy rate. Vacancy rate is also one economic indicator as it provides a representation of the broad market conditions such as capital growth.

This is a very useful statistic that can help property investors assess the extent of rental demand in a suburb. Because it indicates the degree of rental property supply in relation to tenant demand.

What is the Importance of Vacancy Rate?

A vacancy rate of 3% is considered healthy because it represents a market balanced between tenants and owners. Areas with vacancy rates of less than 2% mean high rental demand, while vacancy rates above 4% mean that there is more housing supply than demand.

Suburbs with low vacancy rates – 3% and lower – are often called “tight” rental markets. This type of market suggests a high rental competition, where rents are more likely to be increased and landlords can have their pick of tenants, making it a landlord’s market.

“Get your Access to our Fully Customisable Investment Property Research and Analytics Tool Now!”

Areas with vacancy rates above 3% indicate a poor rental market also known as a renter’s market. Renters have the upper hand as landlords are forced to compete with one another to have their properties tenanted. This means that tenants may be able to negotiate cheaper rents making the market less enticing to property investors.

Is a High Vacancy Rate Bad?

As an analytic metric, a high vacancy rate is a red flag for property investors. However, this doesn’t always mean that the property or the area is not in demand. It just means you will have to do more research to ensure that there is enough rental demand for your property.

You can also get a high vacancy rate as a result of a variety of factors, including:

- Lack of local amenities: More renters are looking to live in areas with an abundance of conveniences such as retail stores, schools, sports centres, and transportation hubs. Properties that lack easy access to these amenities may find it harder to attract and keep renters.

- The rent is too high: If a suburb’s property rental rates are too high, then it will be difficult to fill vacant units, especially if there are similar properties in the area that are more affordable. Also, overpriced rent could cause existing tenants to vacate the property.

- Landlords aren’t keeping up with maintenance: Landlords that fail to respond to tenant requests quickly and appropriately are more likely to experience higher vacancy rates as tenants are not encouraged to renew their lease when the time comes.

- The property isn’t on the same level as others in the area: If a property charges the same rent as others in an area, but doesn’t offer the same amenities, such as a garage, a washer, air conditioning, a dryer, and balcony space, it’ll likely experience more vacancy issues.

Other reasons for a rising vacancy rate include a gradual tenant exiting out of the area, or a new development has been started or completed. Vacancy rate statistics on their own don’t paint the whole picture, so it is important to also consider other trends in the area.

How Does Vacancy Rate Affect Your Investment Property?

Vacancy rates are a measure of the strength of individual rental markets. They are an indicator of supply and demand and have a direct effect on rental income. Suburbs with a high vacancy rate may have an oversupply of rental properties, a higher investment for the investor.

The longer a property remains vacant, the lower the rent collected, and the less valuable it may be to an investor. Because houses may take longer to rent, the suburb rental yield may also be lower than anticipated.

If the vacancy rate is high, your mortgage repayments may get affected. Also, the cost of getting and retaining new tenants can be high, reducing the property’s profitability.

How Vacancy Rate Affects Cashflow

Knowing the vacancy rate can also help investors estimate their cash flow and ultimately, their return on investment. The vacancy rate of a rental property has a direct effect on rental income, which in turn affects your cash flow and return on investment.

When calculating the rental income for a rental property, it is prudent to consider the vacancy rate to anticipate real cash flow. Therefore, your rental income minus vacancy rate minus payments and expenses equals your potential cash flow.

Is Vacancy Rate an Early Indicator of Potential Capital Growth?

Vacancy rates may also be used to project the capital growth potential of a suburb. Since getting a rental space is a lot easier, and cheaper, than buying a property, tenants tend to be more agile than homeowners and investors.

So, when a location becomes attractive to live in, tenants are more likely to move there first. This will drive down the vacancy rate of that area making it attractive for investors. Therefore, the vacancy rate may also be considered an indicator of future capital growth.

What other Data should you combine Vacancy Rate with when looking for the Best Suburbs to Buy Investment Properties?

Although an important statistic, the vacancy rate does not provide a holistic picture of the investment potential of a suburb.

For example, knowing how long rental properties typically remain vacant in an area doesn’t tell you the average rental yield of that area. Here are some other important real estate data points to consider when searching for the best areas to buy investment properties:

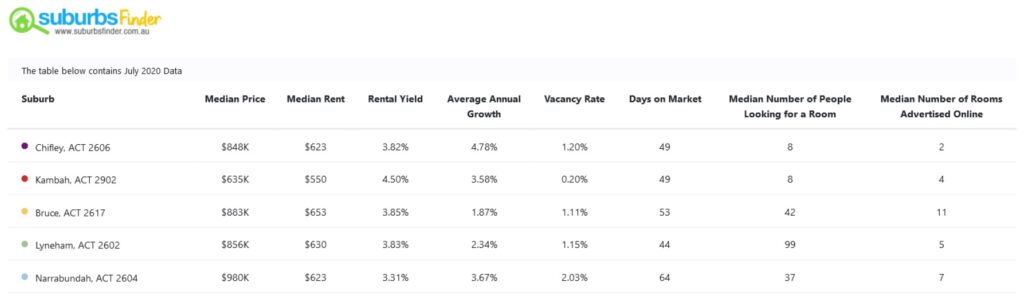

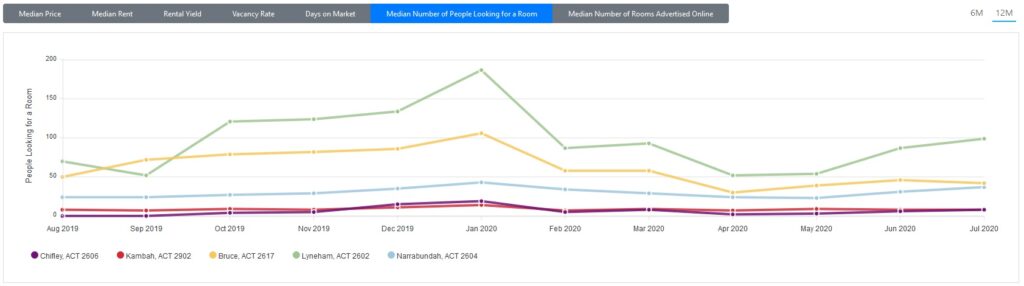

- Days on Market

- Rental Yield

- Capital Growth

- Household Income

- Rental Listings (Rental Stock)

- Sale Listings (Stock on Market)

- Online Search Interest/Demand

- Median Price

- Percentage of Owner and Renter

It is important that you carry out your research and due diligence when planning to invest in property. Combining these different real estate data points will provide the best insights for data driven investment property decisions.

Our fully customisable tool will help you in choosing which areas have both Good Capital Growth and Positive Cash Flow. It lets you narrow down 15,000+ suburbs by combining all 40 data points as filters. It also lets you compare suburbs’ historical & current performance. And once you have identified the best location, it also lets you do feasibility studies on 5 properties all at the same time. Thereby saving time, budget, and covering the full cycle of your investment property research workflow

So, if you think what we’ve built will drastically decrease your time researching for the best location and finding the right property based on your goals and financial situation, sign up for free and give it a try now!

It is the most comprehensive location report of all 15,000+ suburbs in Australia – with linked state, suburb, and postcode.