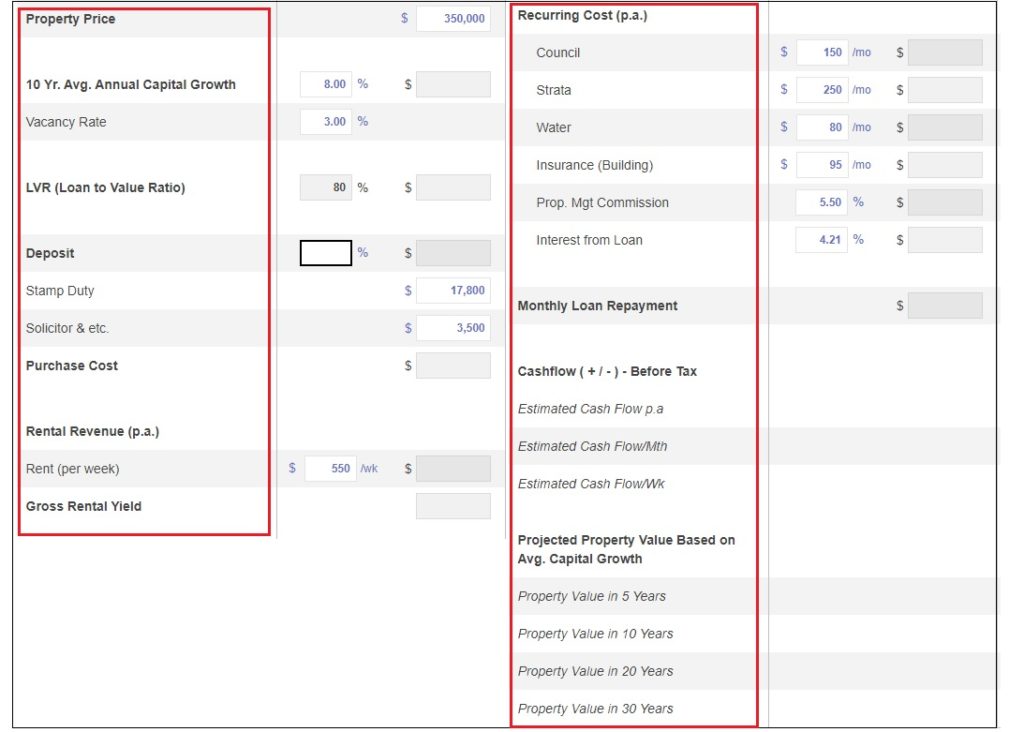

The Investment Property Cashflow Calculator lets you compare 5 different properties at the same time to help you identify the best investment property based on your set criteria -goals, financial situation, and if you’re after Cashflow or Capital Growth or even both.

Let’s just go through all the fields first before you start using the calculator.

- Property price is the advertised price of the property for sale.

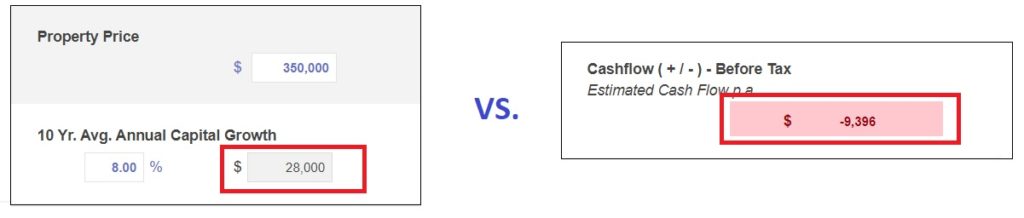

- 10 yr. avg. annual capital growth is the average percentage change in the median price over the last 10 years.

- Vacancy rate is the percentage of all available house, and units in a rental property such as apartment complex, that are vacant or unoccupied at a certain period.

- LVR (Loan to Value Ratio) is the amount you need to borrow to acquire the property.

- Deposit is the available amount you must have to use as initial payment to buy the property.

- Stamp duty is the amount you pay the government as tax for buying the property.

- Solicitors & etc are costs for legal services, documents, and other costs.

- Purchase cost or upfront cost is the total amount of cash required to purchase the property.

- Rent per week is the expected rental return paid per week.

- Gross rental yield is the expected rental return in percentage.

- Council, strata or body corp, water, insurance, property management, and interest from loan are monthly recurring costs for holding an investment property.

- Monthly loan repayment is the amount you pay the bank based on the interest rate on your loan.

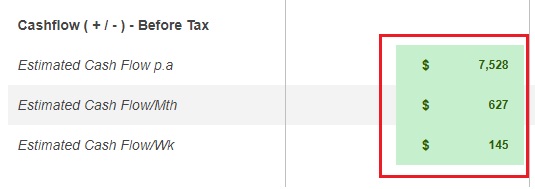

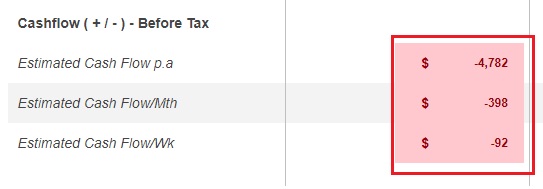

- Cashflow before tax is the amount of profit that your investment property is making after deducting all the cash expenses related to your real estate investment. A positive cash flow investment property is a real estate property that is generating more money than what it costs monthly or annually.

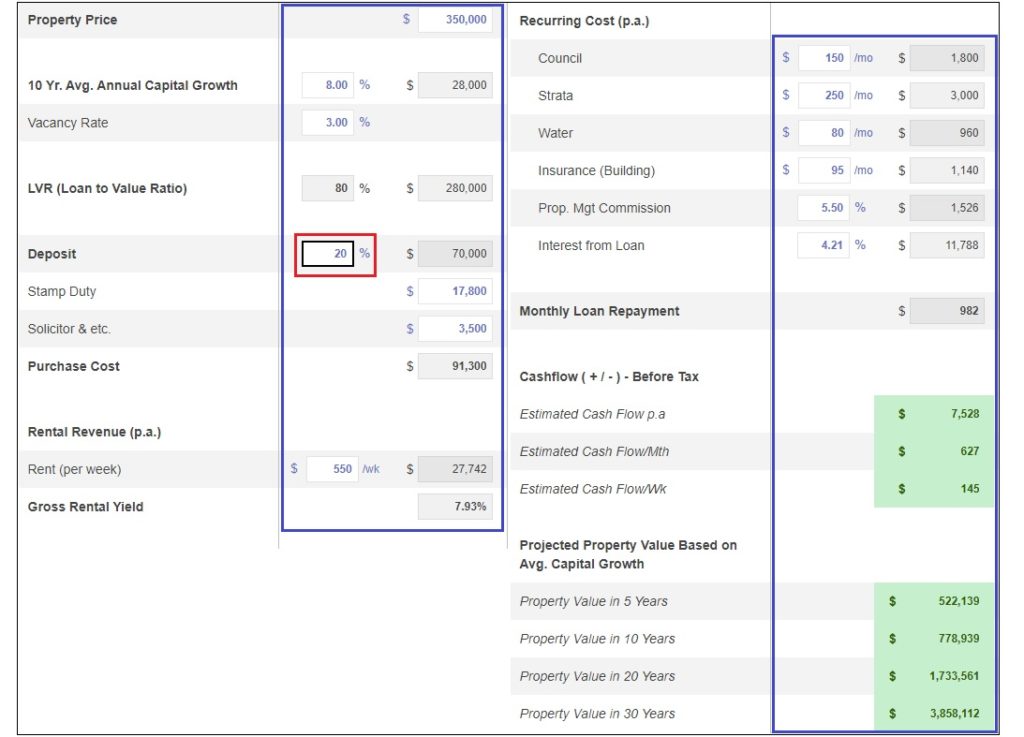

- Projected property value based on average capital growth is the forecasted value of your investment property in 5, 10, 20, or 30 years. A suburb with an average annual capital growth of 8% is expected to double the median property price in 10 years.

Now that you understand what those fields are, you can start using the calculator.

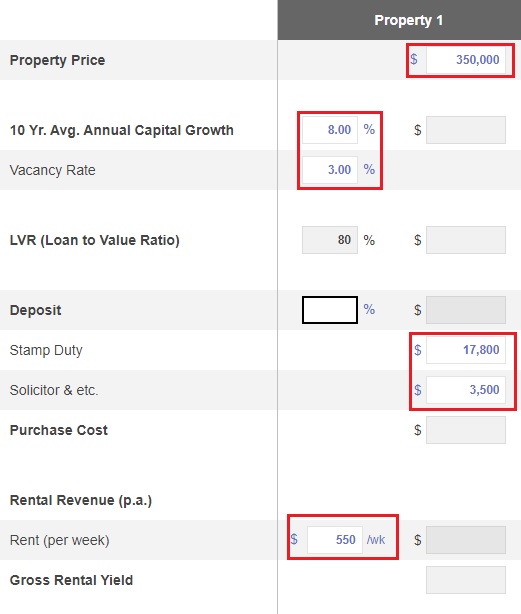

All fields have been pre-populated with numbers in Blue except for the Deposit field. You can always update the pre-populated fields later or anytime you want.

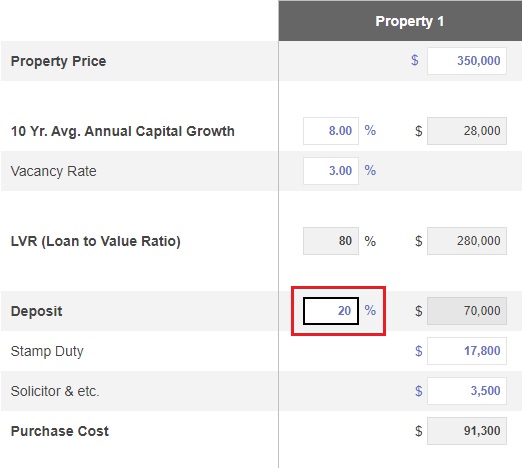

If you’re happy with the pre-populated numbers, you can start by typing 20% in the Deposit field. This is the percentage of the property price as your deposit.

Anything under 20% will require you to pay Lenders Mortgage Insurance or simply LMI. The calculator was made with the assumption of 20% as the minimum deposit to avoid LMI.

After you typed 20% in the Deposit field, the calculator will automatically compute the values for all the fields.

The cashflow before tax fields is green when it is a positive cashflow property. Positive cashflow per annum, per month, and per week are displayed so you know how much extra money you’ll have.

The cashflow before tax fields is red when it is a negatively geared property. Negative cashflow per annum, per month, and per week are displayed to give you better understanding if this is too negative for you based on your current financial situation.

Just a tip, if you have an average capital growth of 8%, which in the example would be worth $28k equity in a year versus $9k negative cashflow in a year, it would still be worth an investment. But always consider your current financial situation if $9k is something you can manage without affecting your finances.

If you are comparing 5 different properties within the same suburb or area, you can copy all the values of the first property to the other 4 by clicking the “Copy inputs to Property 2 to 5” button. Then you can just update the Property Price and Rent per week to determine which one of the 5 properties would be the best.

Now you know how to use it, why don’t you give it a go. Just update the pre-populated numbers in Blue to match your requirements.

Remember, Smart property investors always crunch their numbers to determine if it’s worth investing or not. Are you one of them?