Properties are under the same jurisdiction of supply and demand, and they determine the price of the goods and services provided by each property. Thus, it is necessary to consider these indicators to organize your property options to invest in. As time passes, supply and demand figures exceed each other, however, there are chances that they reach an equal balance.

But how do you read the supply and demand indicators, and what do you do with them for property investing?

First, how are supply and demand used to invest in real estate?

Investing your time, money, and effort into one thing needs in-depth research and analysis. This same concept relates to real estate investment. Investors aim to profit from their ventures, so they have to strategize based on the numerical data provided. Various other indicators influence the prices of properties, but supply and demand have the most outstanding contribution.

Supply is the number of properties available for use or properties to be sold in the market. Demand is generally the buyers’ desire to purchase or rent properties in the market.

Supply and demand are always paired together because they are relative to each other. When there is more supply than there is demand, then prices for the property and rental rates decrease significantly. When there is more demand than there is supply, the prices are put under pressure, and the price increase substantially.

Like all other factors, the demand to supply ratio follows the trends of the market in the area. Assessing it gives an edge for investors to formulate plans and make decisions which guarantees continuous tenancy, stable rental income and capital growth.

What are supply and demand indicators in property investment?

A property investor must consider certain indicators because potential capital growth and rental returns depend on them. Supply and demand indicators branch out in order to support the broader term it is under. These factors are, but not limited to: stock on market, days on market, vacancy rates, renter population, and auction clearance rate.

1. Supply indicator

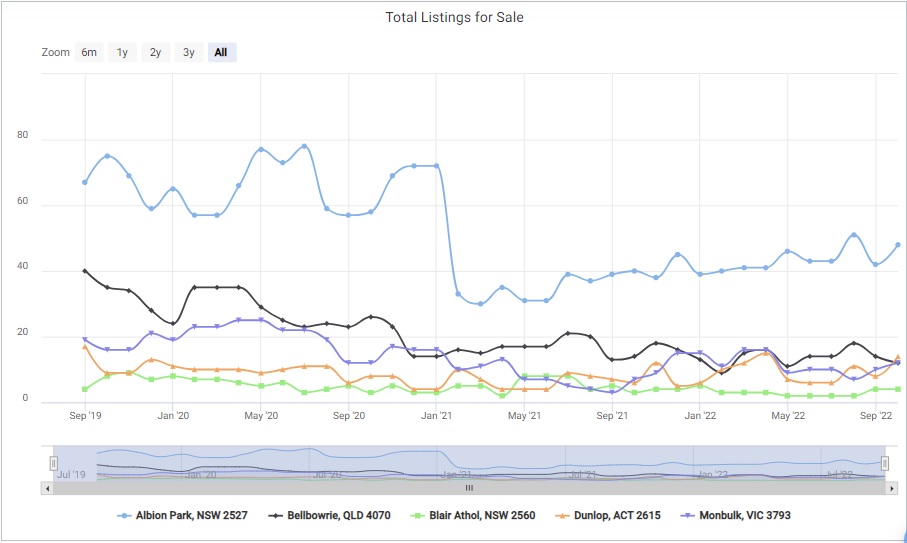

a. Total Sale Listings

Supply is sometimes referred to as stock levels. Total sale listings are the amount of properties that are up for sale within the area. Higher total sale listings indicate that the supply of properties may be greater than the demand.

Having high indications of listings means that it is harder to implement a costly rental rate since there may be too much competition within the area. Low indications of listings may be good, but if the listings are low to non-existent then it could also prove to be a problem because this usually correlates to low demand.

2. Demand indicators

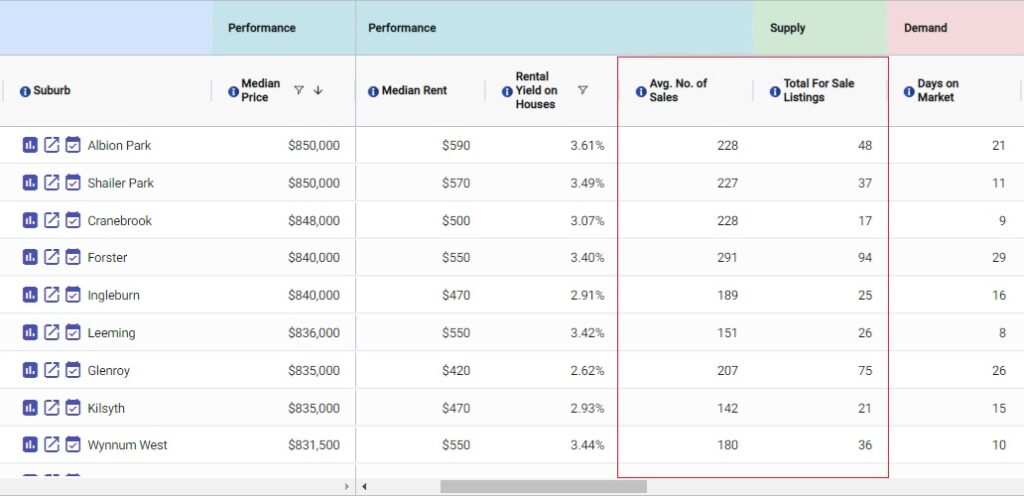

a. days on market

Days on market indicates how long a property has stayed in the market from the time it was open for sale up to the day it was sold. Investors typically use this statistical data to determine the standing of demand for that area or suburb. A maximum of 65 days can be a basis for potential investment. Any more than that proves that the supply of properties is strong and the demand for property or the average days on market for that area is relatively soft or weak.

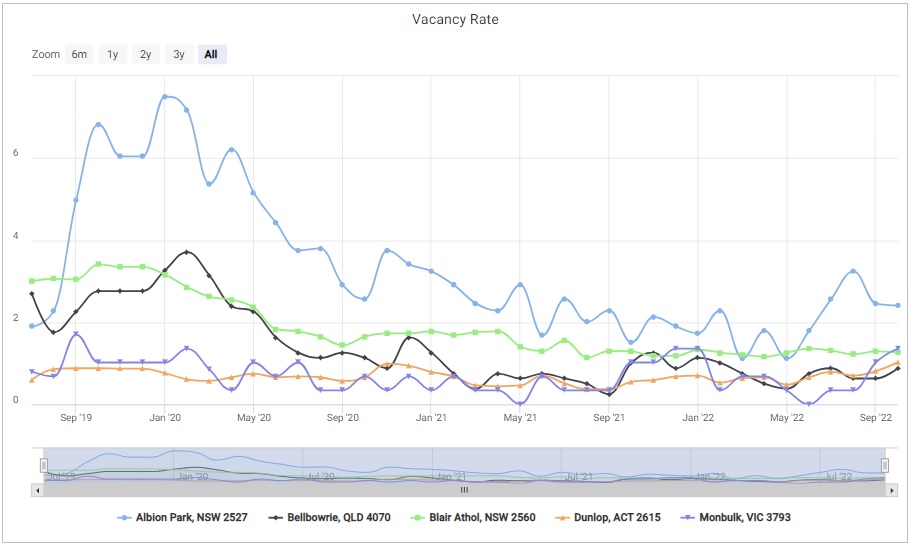

b. vacancy rates

The vacancy rate is the days when the property is available and vacant. The vacancy rate is determined in percentage, higher percentage rates mean longer vacancy period between tenants. Average acceptable vacancy rate is around 2-3%, but it entirely depends on individual investors. Higher vacancy rates tend to put pressure negatively on the potential capital growth and rental yield.

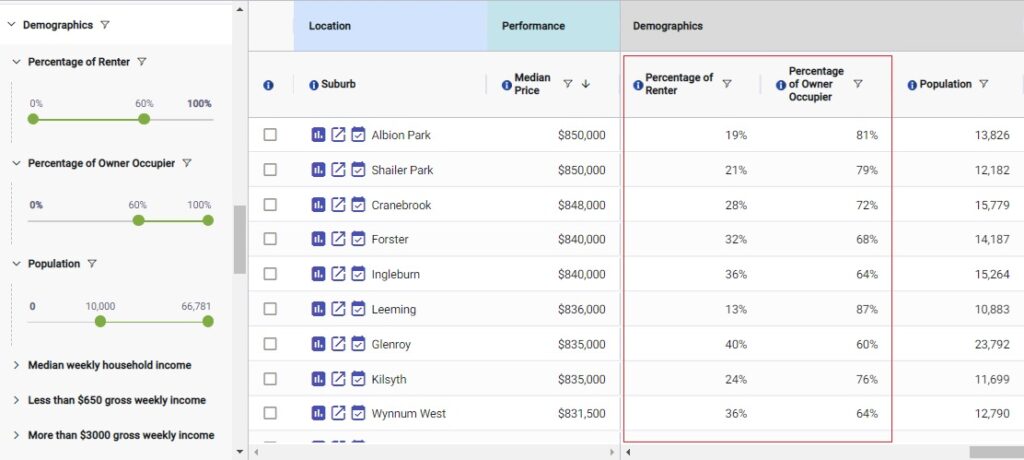

c. renter population

Check out “How to Use Demographics Data for Research in the Property Market?“

Renter population is the amount of renters in the overall area or suburb. Renter population is relative to property rentals and it is usually in proportion to the population of property owners. Fewer renter population proves that there may be lesser tenants who have the desire to rent properties.

d. auction clearance rate

Auction clearance rate is the rate of which a property can be sold in a certain market area or suburb. If properties of an area have low auction clearance rates, then the market condition of real estate is considerably soft. Take note that auctions and auction clearance rates are more established in fast growing developments and cities like Sydney for example. Auctions are less known in other areas with slower suburb growth rates.

“Get your Access to our Fully Customisable Investment Property Research and Analytics Tool Now!”

TIPS BEFORE RESEARCH: What is there to take note of before reviewing the supply and demand of a suburb?

As an investor, you must consider a wide range of factors before you are content with your choice of property. But what are simple things that must remain true for an investor to confidently continue their ventures?

1. Time

a. Investors must realize the tidings of time, this just means that time is an indicator of trends. Trends guide the property market to create competition between existing investors and potential buyers.

b. Investors purchase a property at the right time when there are trends that are slowly dwindling down, they must also make sure that the property will still have a chance to rise along with the trend once it picks back up again.

c. Avoid being swept away by the trend and avoid following the excitement of competition as you might end up buying a property at a price that far outweighs its potential rental income.

2. Effort

a. The first effort done by investors is coming up with an investment strategy. An investor must figure out their individual interests and capabilities. What are you comfortable with when working on your investments?

b. How much effort does the investor want with their property investments? Is this about passive income or shall the investment require an active participation?

c. Investors must also exert effort in what they envision for their investments. Property investment is a long-term venture and not a simple one time dealing.

3. Money

a. In property investment, investors must bring out money before the investments can bring back more money. Although there are choices for you to pick from, what determines your future investment is your capability to have money to pay for it.

b. Even though property investment rental income may look attractive, it still depends on the range of which you can afford. Typically, the lower the money range, the more you might need to update or renovate your property.

NOW THAT THE BASIC SUPPLY AND DEMAND INDICATORS ARE IDENTIFIED, WHAT IS THE ORDER OF MANAGING THESE INFORMATION?

How to find out the active property supply in the current market?

Access to data is made easier with the help of online sources. Information on the properties (supply) which are on sale in the market is much more organized with the SuburbsFinder’s online application.

You can find out the list of properties that are currently up for sale and use various filters to narrow down your search for the right property that matches your investment strategy.

Whether you want to look through house listings or apartment units, SuburbsFinder can ultimately help you with its systematic database and provide a realistic presentation of whether the suburb you’re looking into or whether the type of house/apartment unit you’re looking into would have a positive or negative investment potential.

How to find out the amount of properties sold compared to the overall properties listed?

When there is supply, there shall always be demand, it just depends on the amount of each that can manipulate the trends of the market.

If the supply indicates that there’s a large quantity of properties up for sale and the latest data shows that there are not that many sales made, then there may be a surplus of stock on market. If the quantity of properties listed for sale complements the quantity of recent sales, then the demand to supply ratio is fairly balanced.

SuburbsFinder have filters that can arrange property listings based on the amount of properties for sale and where they are in the map. Comparing the quality of the listings versus data on properties sold can help you assess if the advertised asking price is a good deal, overpriced or can be negotiated.

How to determine vacancy rate for potential property investments?

Vacancy rates reflect the demand of potential tenants. A small vacancy rate means that the time a tenant rents that property is longer than the time which the property is vacant of any tenant. Higher vacancy rates are directly proportional to lesser rental income. Thus, investors acquire properties in areas where tenant demand is strong.

SuburbsFinder provides the flexibility for you to check out the vacancy rates based on postcode areas. The displayed information is established from the yearly performance of properties in the suburb.

How to read auction clearance rates?

Auction clearance rate in real estate reveals the condition of the property market in the area. In data sources, auction clearance rate is measured in percentage and it is the amount of properties that are sold at an auction.

The minimum cap of property auction clearance rate is 60%. Any lower than 60% then the property market in that suburb is rather weak and it may prove to have a lower buyer or tenant demand. Low auction clearance rate may negatively impact investment income and prices may need to be adjusted.

Check out “Auction Clearance Rates – How to Understand it Better“

The higher the clearance rate, the stronger the demand of buyers or tenants for properties in that suburb. A thriving property market typically have 70-80% auction clearance rates. Clearance rates can help determine the demand to supply ratio of properties and it can be used as a sign whether to continue investing in the suburb area.

Why and how do major world events affect the regional market? How did COVID-19 influence the property market?

The COVID-19 pandemic is one of the major world events that tested each country’s capability to adapt to new agendas that needed the cooperation of all of its citizens. Local economies folded upon the outbreak that was spread and government authorities implemented safeguards to prioritize the health of the citizens first. But even though market conditions crashed, this doesn’t mean that it won’t pick its own pace as it recovers.

This is not just about the Coronavirus pandemic, but generally, major world events can impact certain markets. It just so happened that the pandemic greatly impacted the property market and its corresponding communities, and here are the property investment indicators of which are affected by major world events.

1. Lifestyle

a. Through the implementation of quarantines and lockdown, owners, buyers, and tenants have realized the importance of a well-managed house or apartment unit. Investors take this opportunity to purchase properties when prices are at an all-time low and are still in the slow process of price increase as the economy slowly rises back up. Then investors renovate the spaces of these properties to accommodate working remotely lifestyles.

b. Through various initiatives to combat COVID-19, the concept of al-fresco and open spaces have been advocated and became trendy as well. It also generates a positive outlook for people most often staying at home since being close to nature gradually improves the overall mindset and lifestyle of a person.

2. Cost

a. During the early months of pandemic, there have been a significant decrease of property prices. The reason for this is that tenants with lease contracts that have recently ended, started to search for much more cheaper options to help alleviate their monetary expenses. In turn, this affected the property market in Australia to reduce their prices when things where quite uncertain.

b. Monetary policies employed during preliminary stages of the pandemic had also contributed with lower interest rates for loans and mortgages. Although things have been made easier, investors and owners still take the time to consider the long-term results if starting a new property investment.

3. Resilience

a. The economy in general has started to become more flexible as a sign of resiliency. Businesses have adapted to working from home, thus employers can hire more people because the inconvenience of living far from the workplace has been disregarded. Whether living in the Central Business District (CBD) or living in another regional area or even living in a different country would not matter with the notion of working remotely.

“Get your Access to our Fully Customisable Investment Property Research and Analytics Tool Now!”

How long do these world events, especially COVID-19 affect the property market?

World events dwindle down depending on its degree of impact, its proximity radius, and the capability of key leaders to mitigate the repercussions. The notion of new normal manifests in the resurgence of the urban and rural market. Business hubs have gradually opened its doors to invite its citizens while still taking care of the general public’s health and safety. Business hubs and district centers will prosper, but the growth rate would be lower than how much it has flourished over the past 18 months.

The novelty of working remotely eventually wears off since we, as humans, are social creatures. Meeting people, getting to talk to them face to face, and being able to appreciate their physical presence gives off a different feeling of affinity rather than just being able to message them or call them. The same goes for employees that typically work as a group because it is much faster to correspond ideas, decisions and relay information when the people are within reach.

The economy is pressing forward which influences the people and resources to follow this upward flow. Since Australia as a whole has finally stabilized, its borders have opened which encouraged tourists, immigrants and international students to find opportunities in its metropolises. With the convergence of all these people wanting to live in Australia, the demand for properties especially in the Central Business Districts rose considerably and prices have increased to accommodate the sudden demand.

Investors must have a sharp eye when reading into the supply and demand indicators, but they must also be savvy in terms of the trends of incoming new immigrants and tourists. When choosing the proper investment, always keep in mind that the property must not only work for you but it must also work for your potential tenants. Investment strategies are very important and can influence the direction of your decisions. These strategies must also work with the idealized property in a suburb with high auction clearance rates, good prospective rental income, low vacancy rates, and positive capital growth.