The Days on Market, also known as DOM, time on market, or market time, is the number of days a property remains on the market before it is sold. This timeframe begins as soon as the property has been added to the list and ends when a seller has accepted an offer and signed the contract.

Potential investors should always take a look at the number of days on market when researching an investment property to determine the level of demand. If properties are on the market for a long period, indicated by a high days on market number, it generally indicates there is low demand in that area.

The real value of knowing the days on market lies in comparing the performance of different neighbourhoods and areas. For example, if it takes three weeks to sell a house in one suburb compared to a similar property in a different area, we can surmise that the first suburb is in demand.

Days on market can also be used to track the performance of an area over time. If we see that the suburb above takes less time to sell today than it did a few years ago, we can tell that there is an increase in demand.

How is Days on Market Calculated?

You can calculate the days on market for a particular property or a suburb as a whole. The days on market for a suburb, also known as average days on market, can be calculated by adding up all the days on market for all listings in that suburb and then dividing the result by the number of properties listed.

For example, if 5 listings have days on market of 35, 60, 30, 55, and 45. The average days on market is then (30+60+30+55+45) / 5 = 44 days.

It is important to note that the days on market can fluctuate seasonally just as house prices do. For example, in certain markets, the average days on market may increase in winter compared to other times in the year. This real estate data can be used by both buyers and sellers to get the best insights when making investment property decisions.

How Knowing Days on Market Helps A Buyer?

Days on market lets buyers know about the demand for properties in an area. Since an area with a low DOM indicates a hot market, buyers will be more inclined to make a bid when a good property becomes available.

However, buyers may start asking a lot of questions if the DOM is high. They begin to ask if the property is overpriced or if there are any problems with it. This may cause them to want to negotiate more or resist making a great offer because properties in the area take much longer to sell. When a suburb’s DOM is high, it is also known as a buyer’s market.

For example, if you see a property that has been listed for more than 100+ days, while the average days on market for that suburb is 50 days, this tells you that either it is priced too high, or there is something wrong with the property that’s prevented other buyers from biting.

If you look closer and find that the price of the house has not been reviewed since it was first listed even after spending a long time on the market, you might conclude that the seller is either asking for an unrealistically high price or not very motivated to sell.

“Get your Access to our Fully Customisable Investment Property Research and Analytics Tool Now!”

On the other hand, if you see the price of the house has been reduced several times since its first listing, you can tell that the seller is motivated to sell and more likely to appreciate an offer. As you can see, the days on market can give you insight into the seller’s mindset, and help you develop your negotiation strategy.

How Knowing Days on Market Helps a Seller?

Days on market lets sellers adopt a good pricing strategy for their properties, especially when combined with data on number of properties for sale in the suburb and their price range. Sellers can be more aggressive with their pricing in neighbourhoods with a low DOM because buyers are willing to close on houses quickly.

However, they have to be more careful with their pricing in areas where properties remain on the market longer than the average time it takes for comparative homes to sell. A house with a high DOM can become uninviting to potential buyers. It helps to keep an eye on the average days on market of comparable houses to track how yours is performing.

How Days on Market Affects Median House Prices?

Median house prices are a direct reflection of activities and trends in a suburb’s property market. A high DOM can make some real estate investors sceptical about an investment property causing it to remain on the market for even longer.

In this situation, sellers may be forced to review their prices (by reducing them) to appeal to buyers. If this happens to enough houses in a suburb, it can lead to a significant decline in median house prices over time as sellers adjust their prices to remain competitive.

Why would a property be on the market for a long time?

- Being Overpriced: One of the most common mistakes property sellers make is pricing a house higher than it is worth. This can occur for several reasons. They may have been misled by the listing agent or had incorrect appraisals—especially if the house has been improved/renovated to increase its market value.

- Limited Inspection Times: Some property agents may try to steer buyers into closing on specific properties where they have a bigger commission and downplay the potential of other competing properties. Buyers may also suspect their agent of unprofessional business practices and choose to back out.

- Inadequate Visuals: The property market is a visual one and buyers are likely to pass over a listing with a picture or two in favour of houses that have multiple photographs showcasing their different features.

What is a Sellers or Buyers Market in Relation to Days on Market?

When the demand for real estate properties is higher than the supply, sellers have more control over property prices with less room for negotiation. This is known as a seller’s market and is usually indicated by low days on market and increasing property prices.

However, if the supply of real estate properties is higher than the demand, real estate investors have more bargaining power which creates more room for negotiating. This market condition is known as a buyer’s market and is usually indicated by high days on market and decreasing property prices.

How to Reduce Days on Market?

- Be realistic about your pricing. Although it may be tempting to wait for an offer that is close to your asking price, you may need to lower the price if your house remains on the market for longer than usual. For example, the average DOM in your suburb is 35 days and your property has been on the market for 90 days, you may need to review your asking price.

- Present its best features. Show off the property in its best possible state. Think clean, modern, and decluttered. Also, pay attention to its curb appeal to keep buyers’ interests up.

- Carry out all necessary repairs. Nobody wants to buy a property that is going to need a ton of work to bring up to standard. Make plans to carry out all necessary repairs before inviting potential buyers.

- Hire better agents. If possible, carry out some research into your real estate agent/agency before working with them or endeavour to work with a reputable agent with great reviews to avoid disappointments.

What External Factors Affect Days on Market?

Another reason why a property may remain on the market longer than others in the same suburb is poor marketing. Gone are the days when you can make do with a ‘For Sale By Owner’ sign. To grab the necessary attention today, you may need to consider listing your property on multiple real estate websites.

The quality of your house photographs is also important. It should look professionally inviting and this can be achieved by staging the interior to entice potential buyers.

Finally, ensure you are open and honest with potential buyers.

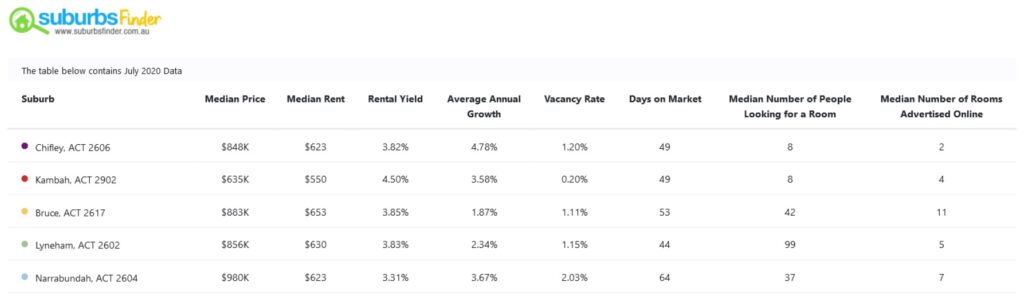

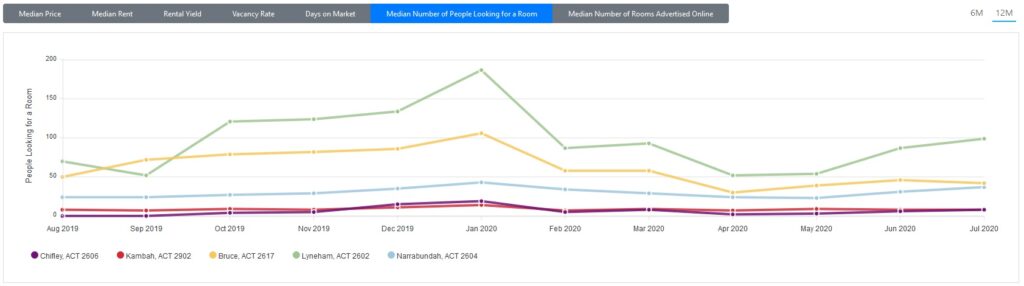

What other Data points should you Combine with Days on Market when looking for the Best Suburbs to Buy Investment properties?

Although an important real estate data, the DOM rate does not provide a holistic picture of the investment potential of a suburb.

For example, knowing how long a house remains on the market before being closed on doesn’t tell you the vacancy rate or rental yield which will give you more information on your potential ROI. Here are some other important real estate data points to consider when searching for the best areas to buy investment properties:

- Rental Yield

- Capital Growth

- Vacancy Rate

- Household Income

- Rental Listings (Rental Stock)

- Sale Listings (Stock on Market)

- Online Search Interest/Demand

- Median Price

- Percentage of Owner and Renter

It is important that you carry out your research and due diligence when planning to invest in property. Combining these different real estate data points will provide the best insights for data driven investment property decisions.

Our fully customisable tool will help you in choosing which areas have both Good Capital Growth and Positive Cash Flow. It lets you narrow down 15,000+ suburbs by combining all 40 data points as filters. It also lets you compare suburbs historical & current performance. And once you have identified the best location, it also lets you do feasibility studies on 5 properties all at the same time. Thereby saving time, budget, and covering the full cycle of your investment property research workflow

So, if you think what we’ve built will drastically decrease your time researching for the best location and finding the right property based on your goals and financial situation, sign up for free and give it a try now!

It is the most comprehensive location report of all 15,000+ suburbs in Australia – with linked state, suburb, and postcode. It’s the perfect tool for property investors looking to buy a property.