By buying an investment property, you can potentially earn a great rental income, a capital return and take advantage of tax benefits.

More first home buyers than ever are choosing to invest in property rather than buying an owner-occupied property or choosing to be a “rentvestor” instead.

There is however, a common misconception that property investing always delivers positive returns, while this is true most of the time it certainly isn’t an instant road to riches. You need to keep in mind that how effectively you manage your investment will determine whether or not the investment helps you reach your financial goals.

Beginning Property Investors Should Always Buy the Property Based on Analytical Research

When buying an investment property, there is generally a lot less emotion involved than when buying your own home. Allowing your emotions to cloud your judgement means you are more likely to over-capitalise on your purchase, rather than negotiating the best possible price and outcome for your investment goals. You’ll want it to be in a good area, and to be a property that will produce sound yields and has potential for growth. While you also want an investment property to be good quality and nice to live in, your tastes and feelings shouldn’t come into play as you won’t be the one living there. However, if it’s possible that down the line you will want to downsize/upsize into your investment property, you should keep this in mind when looking at potential properties.

What do I Need to Consider when Purchasing an Investment Property?

CAPITAL GROWTH – The reason you invest in anything is to make money, so capital growth is the most important thing. Where are you buying? What is around? Is there potential for more development, or will demand outstrip supply? These are the questions that will generally increase your value if you choose somewhere with them in mind.

If you want to put a figure on it, purchase properties that have the potential to double in value every seven to ten years.

Most investors probably don’t see much difference between getting 8% per annum and 11% per annum from their investment. While 3% per annum doesn’t sound like a huge amount, you might be staggered to find out the cumulative differences to the level of wealth created over time.

“Get your Access to our Fully Customisable Investment Property Research and Analytics Tool Now!”

If you invested $400,000 in property and received a capital growth rate of 8% per annum (let’s ignore income and expenses for this illustration to keep it simple) it would be worth $1,864,383 after 20 years. If you managed that investment just a little better and you could derive 11% per annum, that same investment would be worth $3,224,949 after twenty years. That’s a staggering $1,360,566 difference! The impact of leverage makes the difference on the return on capital invested even more impressive.

RENTAL YIELD – The total annual rental income received from a property. It’s expressed as a percentage of the property’s purchase cost. It is used for assessing a property you want to purchase and for tracking how your investment properties are performing. The higher the yield, naturally, the better.

Checking the rental yield can be another one of those quick statistics you research as part of your initial due diligence. You should use the yield to estimate cash flow and to calculate projected return on investment. The yield can also be used to predict potential for capital growth. But you need to make sure that the yield is not high due to falling property values, rather from rising rents.

It’s also important not to get carried away with chasing high yields. Many investors place too much emphasis on the yield without focusing on the big picture – total return versus risk.

Cash flow is obviously an important part of investing. If you can’t service more debt, then you can’t acquire more property. But if you have good cash-flow and poor equity, you also can’t acquire more property. So a balance is needed and this balance may change depending on each investor’s circumstances.

VACANCY RATE – It is a great indicator of the level of tenant demand in a particular suburb. Investment properties in good locations have low vacancy rates, and vice versa.

Put simply, every week that your investment property is vacant costs you money. And the more desirable your investment property’s location, the more rent you’ll be able to charge your tenants. Low vacancy rates will also help your capital growth prospects over time.

Desirable locations usually have most (or all) of the following characteristics:

- A good public perception

- Close to good schools/universities

- Good shopping facilities

- Close to the beach

- Close to the CBD

- Good public transport facilities

- Plenty of things for people to do on the weekend (like restaurants, cafes, entertainment venues, parks, etc.)

Tenants will often pay a premium to rent in areas that offer these characteristics.

DEMOGRAPHIC INFORMATION – These are statistics that describe the characteristics of people, households and dwellings in a particular location.

- The average age and income levels of a suburb’s residents

- The population of the suburb (including growth rates over time)

- The proportion of residents that are employed in broad categories (e.g. white-collar workers versus trade-related occupations)

- The average number of people per household

- The proportion of residents that are renting versus buying versus owning

- The average prices for houses, townhouses or units/apartments in the area (including growth rates over time)

- The proportion of houses, townhouses, and units/apartments

All of this information can be useful for determining the type of tenant that will potentially be attracted to an investment property in a particular location.

But where is the best place to buy an investment property? What are the best suburbs to invest in? Where can you buy property for below $500,000 with a Rental Yield of 5% and above? These are the most common questions property investors ask and it involves a lot of time researching to find answers to all of these.

The good news is, we’ve already done those hard work for you. Within seconds, you’ll be able to identify which suburbs you should buy an investment property that is within your budget.

By just filtering and sorting, you’ll be able to identify which suburbs

- Have a good demographics of people

- Have a median price that will suit the amount you’re willing to invest, especially the suburbs with a median of $500k and below

- Have More than 5% Annual Capital Growth

- Have More than 5% Rental Yield

- Have Less than 3% Vacancy Rate

It is the most comprehensive investment location data of all suburbs in Australia – with linked state, suburb, postcode, average annual growth, median property value, median rent, gross rental yield, vacancy rate, population, gross weekly income, median monthly mortgage repayments and more. It’s perfect for property investors, buyer’s agent, real estate agents, property managers, mortgage brokers, valuers, and even property developers.

Once you’ve identified which suburbs are the best for investing a property don’t forget to do your due diligence and check if the numbers stack up.

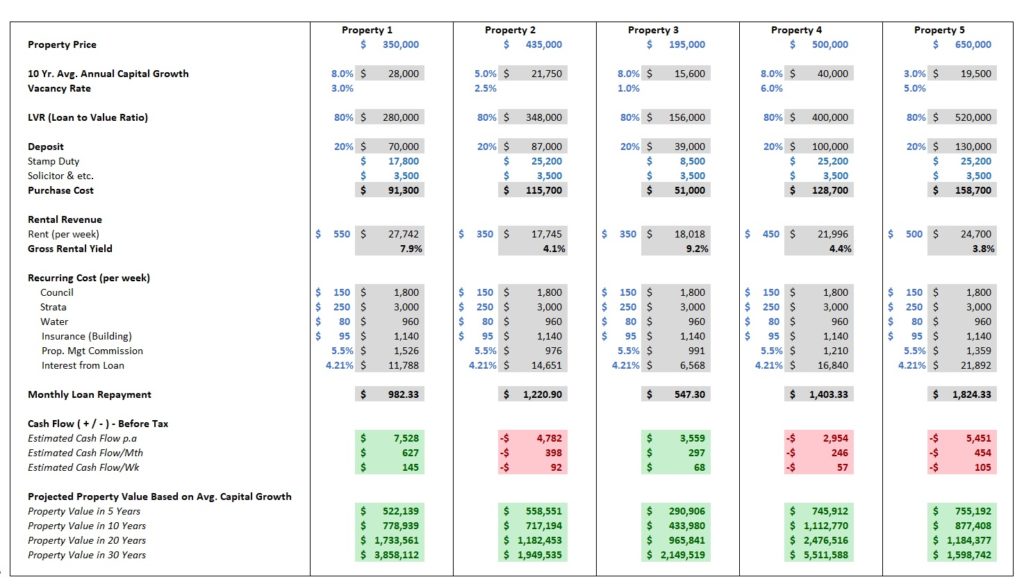

Check out our All-in-One Investment Property Calculator

The most simple and easy to use tool to calculate Rental Yield. It gives you a quick way to compare returns on different investment properties (or investments). It’s a Rental Yield Calculator, Mortgage or Home loan Calculator, Cashflow Calculator, Purchase Cost Calculator, and it also calculates the Forecasted Property Value by Capital Growth. It’s perfect for property investors, buyer’s agent, and real estate agents.

Remember it’s a long-term investment

Investing in property is not a short-term matter – you should be in it for the long haul. It’s important to make sure you can maintain payments over the length of ownership, and while rent will be coming in, it’s important to budget for if the rent doesn’t cover the mortgage, bills, rates as well as any other issues that may pop up. Always have a backup finance option in place in case circumstances change, such as the property is uninhabitable for a short period of time or the local property rentals change.