Price of properties in Sydney have risen for the last five to ten years. The good news is that both investors and homeowners have struck it gold for being there at the right place and time.

The BIG question now is: “Am I too late to buy a property?” Of course, the answer is a “NO!”

The assumption is this: These investors may have been bothered with the idea that they’ve invested way behind as they should.

What they realise are the following: growth of the well-selected property, the forces of leverage and gearing, the strength in compounding and the substantial tax breaks.

Some questions certainly come into mind such as:

- How much time will it take to build a huge portfolio of properties?

- What if I’m in my later age, say mid-40’s to 50’s is when I only have acquired a single property?

- Shouldn’t I have more properties – say, at most 10, which will obviously count to a few more

- good years at the very least to build-up?

The possibilities are absolutely endless in property investment. It may take one’s intelligence and creativity to uncover these opportunities. As it is, property is a variable means of wealth creation just waiting to be tapped. Talk about classifying property assets, handling employer super, dealing with several types of financing, and other various classes of assets in any one of the wide-ranging structures and relationships.

Suffice it to say, you can change your mindset to a different one. As being too behind to have investment property – the more logical question can be, “At my present state, how can the property I have yield the MOST given the situation that will ensure me a very comfortable future?

How do the banks and the property industry as a whole distinguish the investors by AGE?

When banks perceive your impending retirement, they are not too willing to lend you money for such a long period of time. It goes without saying that these banks will unlikely be offering you a 25-year loan term, for example.

Age determines the investment strategies that you use simply because of the element of risk. If you are on property investment, 3 things to consider would be: your present financial condition, where you want to go financially as you retire, and the amount of time between the present and the future.

The way to invest in your 30s (and even 20s…)

Aaahh, in your ‘30s must be the BEST stage. You’re slowly going up the corporate ladder and many banks will welcome you with apparently a sense of enthusiasm.

If you are in this age of being in your 30’s — it is highly probable that you will enjoy about 30 more years of active employment. This is a foolproof reason to show that you can make extensive property investments in your stead.

The next strategy is for you to make it happen. Ensure you have a smart investment plan where you initially create your asset base and then as you lower your loan to value ratios gradually shifting into the cash flow stage in your property ride.

“Get your Access to our Fully Customisable Investment Property Research and Analytics Tool Now!”

How to invest in your ‘40s?

In your ‘40s – it is quite logical to use your approximately 20 more years as an income-earner to dwell on spending for some lucrative investment choices.

Following the compound over time theory, the higher your profits will be if you start investing early.

For instance, if you acquire 3 properties at this age priced at $1 million each – their purchase value is at $3M at this time. If you’re keen on the right investment grade property, most likely that amount could double or perhaps even triple once it’s your time to retire.

You’re 50? It’s not too late to invest!

It’s perfect if you have some property assets with you at the age of 50. If you’re just starting, then keep going yet because you can still be good at it. Most lenders, like the banks, think that one can still be productive even after the usual retirement age of 65. You should be able to acquire 20 -30-year loans for your property funds.

At this age, it should be emphasized that what you need is a definite strategy with growth topping your priorities. Have the capital growth designed through development or renovations as long as your finances, experience and tolerance for risks make it feasible.

Start to invest at 60 – yes, you can!

For the 60-year-olds who are just starting to invest – this is for you! Investing might take a long shot in your twilight years. It is tough but doable. Plan to have a property strategist assist you. This person is someone who can freely provide sound advice on your various options. Don’t go for a property seller. There will also be too many limitations which will be considered.

One logical action is to invest through your SMSF (Self-Managed Super Fund). Bear in mind that although this is a good option, some issues can arise such as the procedures on profits for super fund as well as frequent changes on investments and taxation. Thus, a qualified financial planner can provide some help and good advice.

When NOT to Buy an Investment Property:

- If you want to pay less tax

It would not do you good to purchase secondary properties that come with high-valued depreciation allowances that result to undue negative gearing. Most of these newly-acquired properties are offered at premium prices. Sadly, the end-result is not what you expected – there’s not really much capital growth through the years.

Truth be told, negative gearing is only a short-term funding strategy that works in your high-growth investment properties. What are these? The reputable house, condominium, apartment, or town house in strategic avenues or streets of the prominent locations in the suburbs of Australia’s big capital cities.

- If you think FOMO (Fear of Missing Out) is real

FOMO or Fear of Missing Out – many think this is REAL in property investment. People tend to be emotional when they scout for a new home or property. Sadly, investing for the wrong reasons will only lead to bad judgment. Beware of the property marketers and spruikers who will capitalize on your emotions. Do not fall for their schemes, lest you will only regret buying that home later on.

- If you treat it as an “instant rich” scheme

Do you know that a property investor’s financial freedom usually happens for a period of 30 years long? YES – and that’s a food for thought!

- You have no property investment knowledge

Whenever you purchase a property – do it objectively. What are your reasons for buying? Is the property located at the place where you want to establish residence, retire or stay during vacations? It is judicious to choose and obtain your property based on sound investment judgement rather than relying on your emotions. It should still be a rational choice. “Owning a house or living in one makes you understand property investment” is a big fallacy.

It’s meaningful to know that the more successful investors have followed sound investment planning according to their needs and risk requirements. They’ve designed a perfect investment strategy that’s been tested by time. This resulted to the achievement of their long-term objectives which have remained powerful in the long run.

- You’re not financially fluent (You’re lacking in financial literacy)

Most investors are considering investing in property to add to their cash flow. However, making an extra loan out of it will just be challenging if they do not have the essential financial controls and cash management abilities.

- You’re eyeing an all-purpose property

If your goal is to make money in acquiring a property, but count it as a future home or a retirement home or maybe an occasional holiday home all at the same time! Oh well, there’s just too much for all your interests in that ONE piece of property to go for.

- Your finances are not well

Property investment is a finance plot drawn-up with real estate at its climax.

Getting into property means you have a decent-paying job, a profession that you practice or a business you engage in that provides a steady flow of income. You need to be constantly appealing to the banks which lure you into borrowing. But of course, you also need a sizable amount of funds to act as your financial buffer that will help you tide through the tough days ahead. “Saving for the rainy days,” as they say.

It’s always wise to take your time – buy an investment-grade property rather than settling for a secondary property while you haven’t saved much or can’t do loan repayments.

Timing the market and finding that hotspot usually fail

There are surely many opportunities for every investor out there with a large number of property market options. These property markets are so dynamic and operate within cycles. It is remarkable to see one investor buying near the bottom or maybe finding one hotspot based on its location. The fact is that the platform is plagued by such investors who have timed the market and found that hotspot. Unfortunately, many didn’t succeed.

For now, there’s no 100% certainty on how house prices will be after 10-15 years. But if we will gauge by past experience, it is right to say that the prices will most likely escalate much, if not satisfactorily. It will even be based on few factors like the location where the house is (city/town/suburb) but eventually, the argument is that there is an expected positive direction in the property prices.

It is most likely that you’ll have a maximum of 5% average annual increase in household incomes. This means that in about 10 years or so, you can count at least an additional 40% household money, plus 50% or more if your career will afford you with salary hikes due to promotions and work upgrades.

The odds are all in your favor if you start early in property investing. This means you will allow your assets to increase more over time. There’s also a good chance of flexibility in case you’ve made the wrong move.

It’s best to equip yourself with a group of investment experts who will guide you to the path of financial wealth, instead of you being hapless with your doubtful decisions in the end.

Majority would buy properties recklessly, not knowing that this could be a dreadful decision after all. They always anticipate that the investments made will considerably increase through the years.

In conclusion – regardless of age, a proven effective investment strategy will help you reach success.

There’s no way one can’t achieve financial freedom through an effective investment property strategy. Set your goals clearly and work through a solid, sound strategy to guarantee a great future.

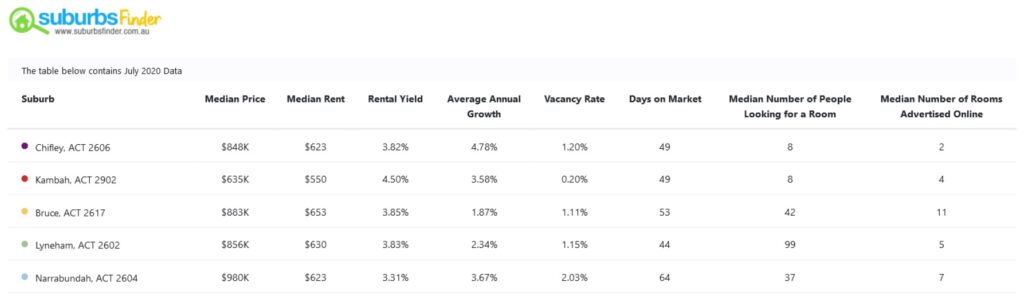

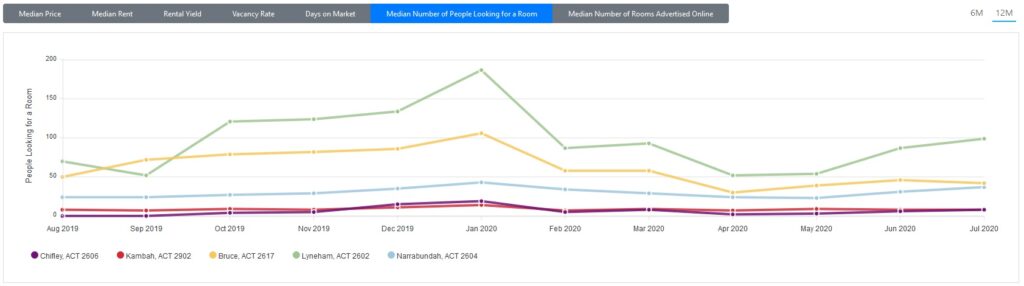

SuburbsFinder is here to help you find the best location to buy investment properties and more importantly, identify the right property to have.

Our fully customisable tool will help you in choosing which areas have both Good Capital Growth and Positive Cash Flow. It lets you narrow down 15,000+ suburbs by combining all 40 data points as filters. It also lets you compare suburbs historical & current performance. And once you have identified the best location, it also lets you do feasibility studies on 5 properties all at the same time. Thereby saving time, budget, and covering the full cycle of your investment property research workflow

So, if you think what we’ve built will drastically decrease your time researching for the best location and finding the right property based on your goals and financial situation, why don’t you sign up for free and give it a try.

It is the most comprehensive location report of all 15,000+ suburbs in Australia – with linked state, suburb, and postcode. It’s the perfect tool for property investors looking to buy a property to rent out rooms individually to have a positively geared portfolio.