Most first-time property investors face a dilemma on which suburb is the best to buy in. Whether you’re looking to attract a particular demographic, push for solid capital growth, or get the highest rental return, finding the right suburb is essential for the entire investment process.

What property should you buy? Just as critical is the question of where you are looking for it.

Choosing to buy a property should be directed by personal objectives and what you want from the property. Being very clear on your goals will considerably benefit your search for the best location.

Buying an investment property means having a different mindset vs. acquiring a property to live in. Therefore, when choosing a suburb, consider these three most important factors as decision points:

Factor 1- Supply and Demand

Law of supply and demand – how does this affect your suburb selection process?

Like any home buyer or potential investor with a budget, the supply and demand factor will play a critical role in your decision.

Suburb property prices, which include the properties you want to buy, rely on the law of supply and demand. Where there is a high demand for properties in a suburb, but they are scarce, the tendency is property prices in that suburb escalate. Which then makes the market a seller’s market.

Conversely, if there are many properties for sale or rent in the market, this scenario can result in property prices plunging.

Scarcity or undersupply also affects the property values.

Let’s say that a suburb will host the new headquarters of a major company. Suddenly, many people are lingering and searching for nearby properties where the new office will be. And their main reason is – they want to have a shorter commute to work. What we can anticipate from this is that the new office can drive the overall property values in the area to increase, even skyrocketing due to very strong demand.

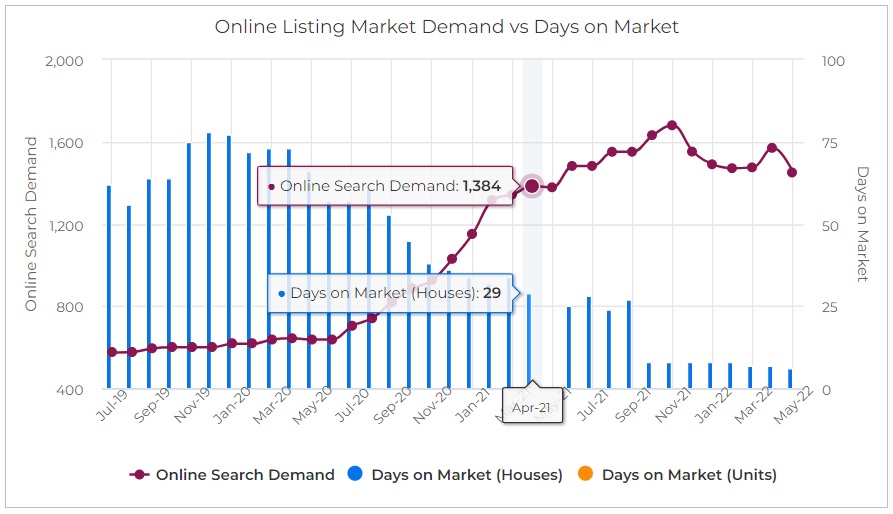

SuburbsFinder lets you overlay Days on Market versus Online Listing Market Demand to provide a better understanding on what’s happening in a particular suburb

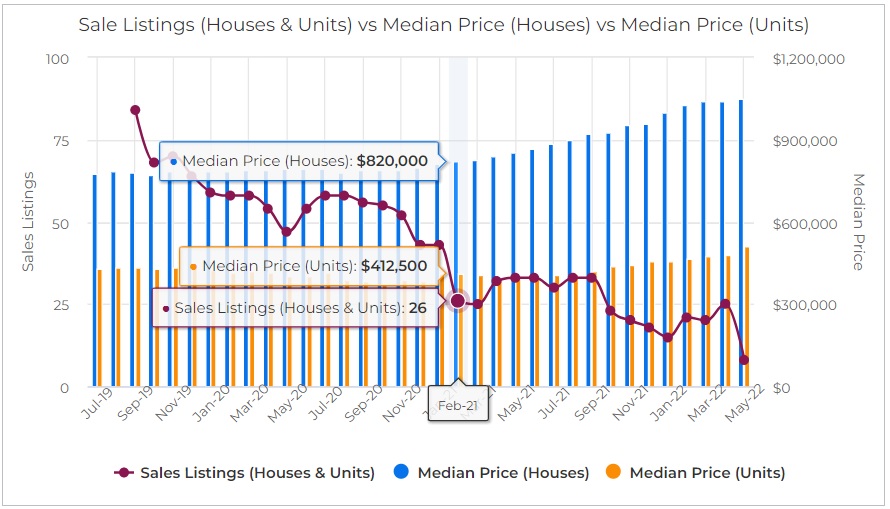

SuburbsFinder also overlay Sale Listings (Supply) with Median Price for both Houses and Units showing the impact on price when supply can’t keep up with the demand

So, why does this situation happen?

- There is demand. There are several buyers in a specific location searching for properties.

- There’s supply BUT it is limited.

- It’s a seller’s market.

Let’s have a sample scenario: Suppose the asking price is $500,000, while the discount is -4% for a suburb. Instead of offering to pay $480,000 – you can perhaps say $460,000 first. When you know of the supply and demand and discounting in a suburb, you can have an upper hand when you present your offer.

Factor 2- Future Growth

Can you really forecast the future growth of a suburb?

Of course, you may not be able to predict the future, but you can check specific indicators to have an idea.

“Get your Access to our Fully Customisable Investment Property Research and Analytics Tool Now!”

Maybe look at the past to give you the historical growth trend of the area. Remember to check on the other factors which can impact the capital growth of one’s property as well, like:

- Checking for growing income in the area (this means gentrification);

- Checking for low vacancy rates and increasing rents (reduced supply but high demand is a good indicator);

- New Infrastructures;

- School catchment areas as this can affect the desirability of property to renters;

- Risk-minimisation strategies as this can help protect your investment; and

- Expert reports as these are a good source of information about future growth.

In general, these expert reports analyse if a particular area is increasing or decreasing in value. They look at different factors to make their predictions about a particular area.

But, if you do use these reports, make sure you always check where the figures come from. Write down the source to compare with the other data you get from other sources.

Perhaps, you may disagree with what’s published, which is fine. As these are expert opinions based on what they’re seeing, and you may have a different perception of how you forecast the future growth of an area.

But even if you disagree with the research findings, it’s still worth knowing the reasons behind the report. You can then integrate your own forecasts with theirs and come up with a strong strategy.

Factor 3: Demographics

Demographics typically refers to the breakdown of the population in an area.

In that case, what do demographics tell you about a potential investment property area?

Generally, demographics and infrastructure go together. It has an interdependent and mutual relationship. Usually, an area where you can find young families may also have several local schools for the children. A variety of schools then attracts more young families into the area.

Places with plenty of commuting professionals may have more access to better options in transport, including modern public transport systems, on-ramps, freeways, and more. The reverse is also a fact. When a suburban area provides these amenities, it can also attract more professionals who usually commute for work.

Other things to consider are the personal preferences.

Why do people choose a suburb versus an inner-city? Suburbs usually are more peaceful and less noisy than urban areas. They also have relatively lower crime rates.

We study demographics primarily to know how the average renter looks like and behaves, and what the market is looking for. By knowing and understanding your market, you can make sure that you have the right property for their needs.

Astute investors also use the demographic data collected in the Census when looking for signs of good capital growth for a specific suburb. Like when a suburb’s population is growing, you can expect facilities to grow too.

“Get your Access to our Fully Customisable Investment Property Research and Analytics Tool Now!”

Final Thoughts: Research is the Key

- Research is key when you buy an investment property. Sadly, one cannot predict the growth of a particular suburb, but you can identify specific indicators which point to whether an area is going up or not.

- Check the location’s rental demand and purchase the specific property that will let you have a property with a very little risk of being vacant.

- There are many things to consider when buying your first property. And getting it right the first time is critical, so it will turn out to be a growing asset that can set you up for your next one. If you feel like it is costing you more initially, look at it from a long-term perspective.

There is so much to learn in property investing, and SuburbsFinder is here to help you. We offer our services to help you find the best location to buy investment properties and, more importantly, identify the right property to acquire.

Take advantage of our fully customisable tool to help you choose which areas have both Good Capital Growth and Positive Cash Flow and to stay ahead of the game, against the less-knowledgeable property investors, local real estate representatives, developers and owners. With our tool, you can narrow down the 15,000+ suburbs by combining all 40 data points as filters. You can also compare historical & current performance of selected suburbs. When you have narrowed down your list and identified the best location, you can also do feasibility studies on five properties you have shortlisted simultaneously.

It is the most comprehensive location report of all 15,000+ suburbs in Australia – with linked state, suburb, and postcodes. It’s the perfect tool for property investors (like you) looking to buy a property with good investment potential.