Do you ever wonder how most successful and renowned real estate investors (the likes of Sam Zell and Donald Trump) hit off successfully with their real estate transactions? How do they win incredible deals using the same exact methods we do?

The answer is simple:

Excellent investors have perfected the “art” of their trade: real estate investing.

So, as a result, every transaction concludes with a masterpiece they can display on their walls, considered their very own masterpiece, the Mona Lisa. “The Art of the Deal,” a Donald Trump book, is based on this theory, so you may want to check it out.

Many investors have difficulty understanding the supposed art side of the science of investing. What they see, like the figures or the formulas and the paperwork it entails, are the only things they recognize. Most investors struggle changing their strokes and adopting new techniques when they dream of becoming a “Donald Trump” in this field of real estate investing. They go back to their usual colorless proofs to have the answers when they should be visualizing and looking at the entire masterpiece and all the lively colors present on every painted stroke.

Check out “How to make use of Supply and Demand Indicators when it comes to investing property?“

In short, good investors know the science behind real estate investing, while great investors have mastered the art form of that science.

Let’s compare the science of investment and the perfection of the art form of that science of investing now.

Here is a famous expert’s take on this:

“You should navigate the path following universal laws supported by numbers and formulas of this naturally-balanced universe to fast-track real estate investing.”

Real Estate Investing is an art form of all THREE Sciences:

- Practical Science – all about the values and the approaches and tactics you use for investing.

- Poetical Science – cultivating the art of establishing rapport with the clients and at the same time building up trust with them. Doing effective negotiations is also part of this.

- Theoretical Science – depends on figures and formulas for one to perform real estate investing.

Let’s have some illustrations of each.

Real Estate Investing: Practical and Theoretical Science

- Transaction Engineering- this includes how you structure acquisitions, asset protection, property management, tax planning, and negotiation, among others;

- Rental Yield;

- Assessment of Repair Costs;

- Analysis of a deal’s profitability;

- Cashflow and Cash on Cash Return Formulas;

- Operating Expenses – this covers the sum of all indirect, overhead expenses, such as property taxes, insurance, maintenance expenses, and more;

- Steps in the assignment of a contract.

“Get your Access to our Fully Customisable Investment Property Research and Analytics Tool Now!”

Having a scientific mind as an approach is what you need if your goal is to make money from property. It is never luck to turn out bucks – use science to measure and calculate your risks and financial success, just like in any other field or business.

Property success is all in the numbers. As much as it is in sciences, there is a space for research and statistical analysis in real estate. If you like doing risk calculations and assessments, the best and only means to analyse the potential of your investment is to gather the raw data. Property is all about location, and that’s a good starting point for your statistical evidence. Before making any informed investment decision, you needto consider and measure several geographical factors.

They include the following:

Available Properties

It is a must to know the mix of housing stock in an area to realise your investment options. It would be best to check the following: available homes – their sizes and lay-outs, number of rooms, and the age of the various structures. Other checklist points are the availability of facilities like a yard or parking, whether the property is managed as a group or a single one, etc. You may add different aspects to your checklist – like what construction materials were used or were these traditional build types of materials, and the like.

It would be best to look into these factors to understand the available property with its potential value and the types of residents who may want to live in that area.

Facilities or Amenities of the Area

The facilities that an area offers determine the potential value of the property and its attractiveness. The extent is based on what you’ve found through studies on the social demographics you like to attract or most likely be interested in your property.

The value of the location having good healthcare centers, schools, transport, entertainment, and leisure activities can be evaluated by comparing areas with such facilities versus those that do not have them.

Demographics

When you know the type of properties, you begin to have a gut feel of the people who may be attracted to an area. This offers you another data set that you can analyse as you look at the income, spending habits, and the lifestyle required for attracting your target clients.

Population Growth’s Recent Trends

Another critical data set that suggests an increasing historical trend or growth in an area’s popularity. This can be determined and deduced to understand how this might increase in the future. If a location grows in demand, it is likely a good investment opportunity.

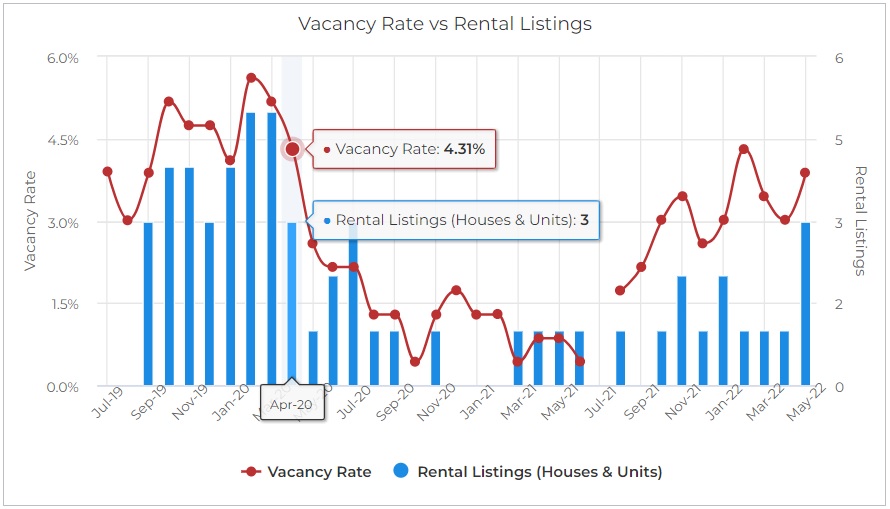

Number of Previous and Present Vacancies

This covers the pace or speediness in which the property changes hands in the area. Like population growth, understanding what this scenario looks like in a specific location can be a basis for forecasting the performance of your investment on the market.

SuburbsFinder overlays it against the Total Rental Listings to provide clearer rental demand performance of a suburb

Examples of Real Estate Investing Science in Arts (Poetic Investing)

- Thinking out of the box – generating leads is an excellent example. Let the leads come to you, do not run after them.

- For every deal, create three kinds of offers. Then, when you present several options for a seller, it is very likely that you can “seal the deal.”

- Generating win/win deals for all. This covers building rapport with the seller, being transparent in communicating your situation so that both sides can agree to a fair negotiation.

- Relationship marketing (i.e., networking on purpose). Attend and participate in real estate seminars, meetings, conventions, assemblies, and other related activities that will give you enough opportunities to initiate and form relationships with others in the same field. This activity is for also for learning and marketing your investing business in the long run.

- Utilising “hypnotic” kind of copies on your marketing program. This means the deliberate choice of specific words or images to influence your audience subconsciously.

- Be the “go-to” person and a real estate investor/influencer in your area. Build your reputation and have a vast network, and soon you will be credible and highly respected in your area.

Now, that we have learned about the sciences behind investing, let’s check what type of investor resonates with you.

“Get your Access to our Fully Customisable Investment Property Research and Analytics Tool Now!”

Which TYPE of investor are you?

1. The passive investor

The passive investor is one who tends not to spend too much time on any due diligence and instead quick to buy one of first properties he sees. In short, he is one who is not really interested in understanding all the ins and outs of a property portfolio, including tax laws, finance, compounding, etc.

Passive investors typically tend to use their emotions in their investment decisions which may often cause devastating results.

2. The active investor

An active investor is one who puts in a lot of effort to find a good investment project. He conducts due diligence to increase the probability of having a good, viable investment purchase.

They generally educate themselves to gain a basic knowledge of the principles involved in finance, property, and taxation, and would seek professional help on bigger things like structuring their portfolios and closing out strategic acquisitions.

3. The analytical investor

An analytical investor is the far opposite of a passive investor.

While it just takes an ample amount of research and due diligence, this kind of investor tends to go overboard and spend a long time (months or worst, years) examining data, asking for advice, and reading materials to find the “ultimate” investment property.

Key Takeaways

Getting wrong in property investing can be an expensive mistake.

Involving experienced and competent experts is the best course of action to take, especially for so many naïve investors, to avoid costly mistakes.

Don’t focus on the science side of real estate investing ONLY – as this can potentially slow down or even stop your growth and dampen your profits. Failure to combine the “science” and “art” of property investment can cost you a fortune.

In the subject of investing, aim to become both a “science geek” and an “art student.”

Property investment data is critical when making an investment decision, but it is just half of the work.

Take advantage of our fully customisable tool to help you choose which areas have both Good Capital Growth and Positive Cash Flow and to stay ahead of the game, against the less-knowledgeable property investors, local real estate representatives, developers and owners. With our tool, you can narrow down the 15,000+ suburbs by combining all 40 data points as filters. You can also compare historical & current performance of selected suburbs. When you have narrowed down your list and identified the best location, you can also do feasibility studies on five properties you have shortlisted simultaneously.

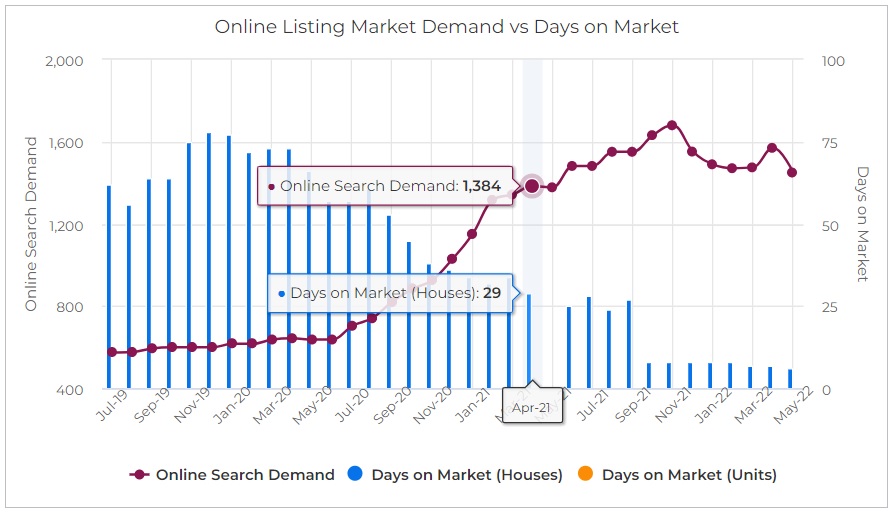

SuburbsFinder lets you overlay Days on Market versus Online Listing Market Demand to provide a better understanding on what’s happening in a particular suburb

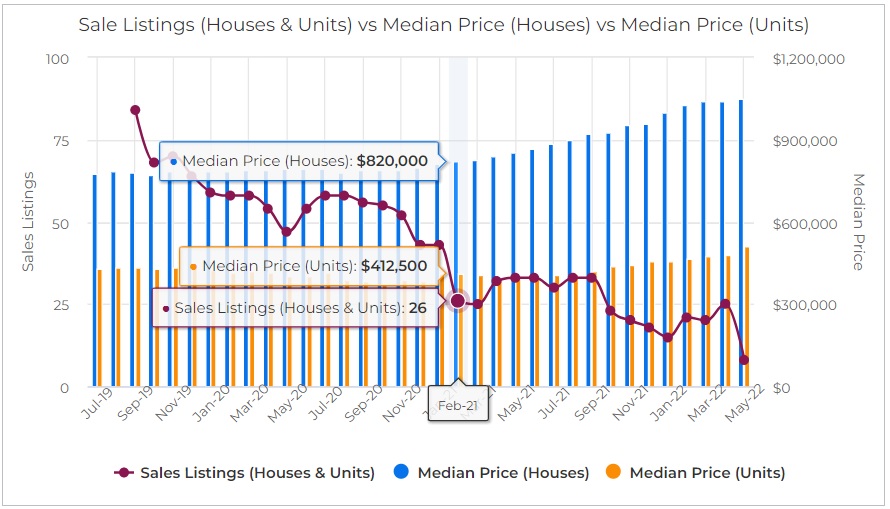

You can also overlay Sale Listings with Median Price for both Houses and Units showing the impact on price when supply can’t keep up with the demand

It is the most comprehensive location report of all 15,000+ suburbs in Australia – with linked state, suburb, and postcodes. It’s the perfect tool for property investors (like you) looking to buy a property with good investment potential.