The Renovation Feasibility Tool lets you compare 4 different properties at the same time to help you identify which one would bring maximum revenue after renovating or manufacturing capital growth and sell after.

Let’s just go through all the fields before you start using the feasibility tool.

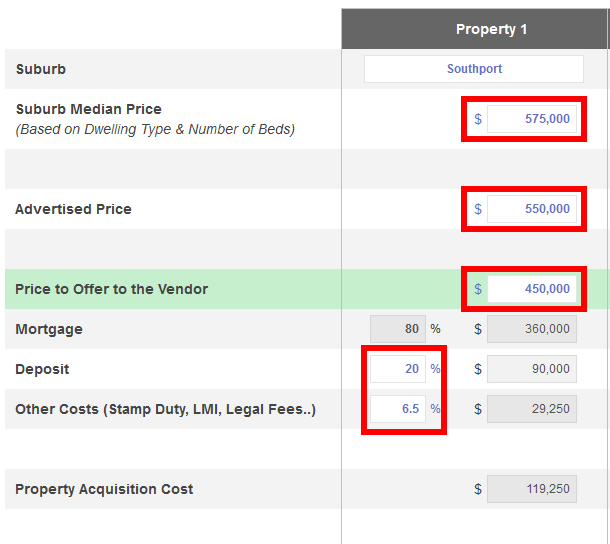

- Suburb is the name of the area. You can also type in the address of the property instead.

- Suburb Median Price is the median property price for the area. Median price varies based on number of bedrooms.

- Advertised Price is the amount required by the vendor for the property to sell.

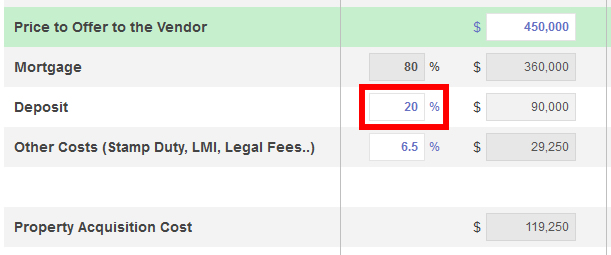

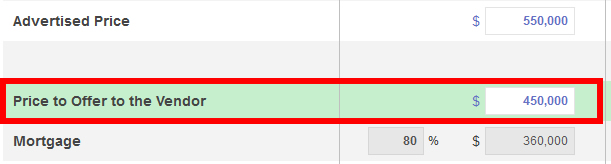

- Price to offer to the vendor is the amount to be offered to the vendor which is usually lower than the advertised price.

- Mortgage is the percentage or the amount you need to borrow to purchase the property.

- Deposit is the outright cash needed to use as initial payment to buy the property.

- Other costs include Lender Mortgage Insurance (LMI) if applicable, Stamp Duty, Solicitor, Pest inspection, etc.

- Property acquisition cost is the total amount required that you must pay right away to purchase the property.

- Renovation cost is the amount required to spend to do the renovation. As a rule of thumb, your renovation cost should not be higher than 10% of the property’s value or sold price if you’re renovating and selling the property. The 10% would include both labour and materials.

- Contingency is an emergency fund which you can use in case some unforeseen event happens during renovation.

- Total renovation cost is the sum of renovation cost and contingency.

- Holding period is the total number of months you’ll hold the property. It starts from the day you settle and ends from the day the property is sold after renovation.

- Monthly repayment is the amount you pay the bank based on the interest rate on your mortgage.

- Monthly council rate, water rate, and electricity are monthly recurring costs for holding a property during renovation.

- Monthly insurance is the amount you pay for the premium of the building insurance which is important when buying a property for flipping or holding.

- Total holding cost is the estimated total amount needed after you settle to the day the property is sold after renovation.

- Selling costs such as agents commission fee, advertising & marketing costs, styling, legal fees for engaging a solicitor, and other miscellaneous costs are the fees associated when selling a property.

- Total selling cost is the total amount to pay when selling the property.

- Total cash needed to fund the project is the sum of outright cash required to acquire and renovate the property.

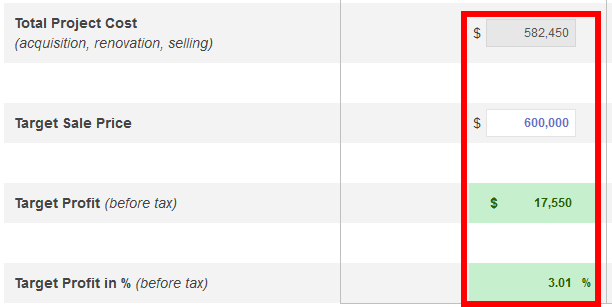

- Total project cost is the sum of total cash needed for the entire project which includes acquisition, renovation, holding, and selling.

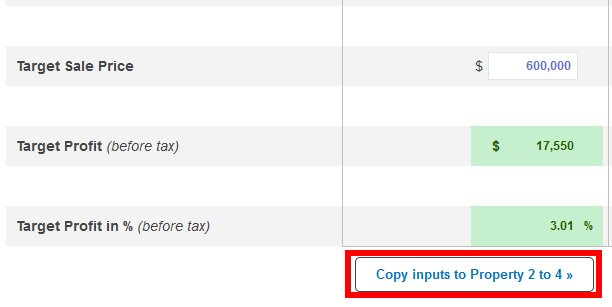

- Target sale price is the amount you aim to sell the property after renovation.

- Target profit is the amount you expect to make, before tax, after selling the renovated property.

- Target profit in % is the amount in percentage that you expect to make, before tax, after selling the renovated property.

Now that you understand what those fields are, you can start using the feasibility tool.

All fields have been pre-populated with numbers. You can always update the pre-populated fields later or anytime you want.

The feasibility tool was made with the assumption of 20% as the minimum deposit to avoid Lenders Mortgage Insurance.

Using the pre-populated values on Property 1 as your example, to make a target profit of $17,550, which is 3% of the Total Project Cost, you need to purchase the property at $450k and sell it at $600k.

3% Profit is not worth all the risk and effort associated when renovating and selling a property. Generally, you should get a $3 return for every dollar you’ll spend in your renovation cost or at least 15% return in your Total Project Cost.

If you want to identify the minimum and maximum target profit for the same property, you just need to click ‘Copy inputs to Property 2 to 4’ and start playing around with the numbers by updating the ones in Blue.

Now that you know how to use it, why don’t you give it a go. Just update the pre-populated fields in Blue to match your requirements.

Remember, smart property renovators always crunch their numbers to determine if it’s worth renovating or not. Are you one of them?